Stronghold Digital - getting back on the front foot

A much more encouraging Q1 2022 reporting after the big disappointment of Q4 21.

I think the stock looks standout value in here. I have built a position back up having very materially reduced after the disappointment of the prior quarter.

Not investment advice, consult your advisor etc.

Summary thoughts:

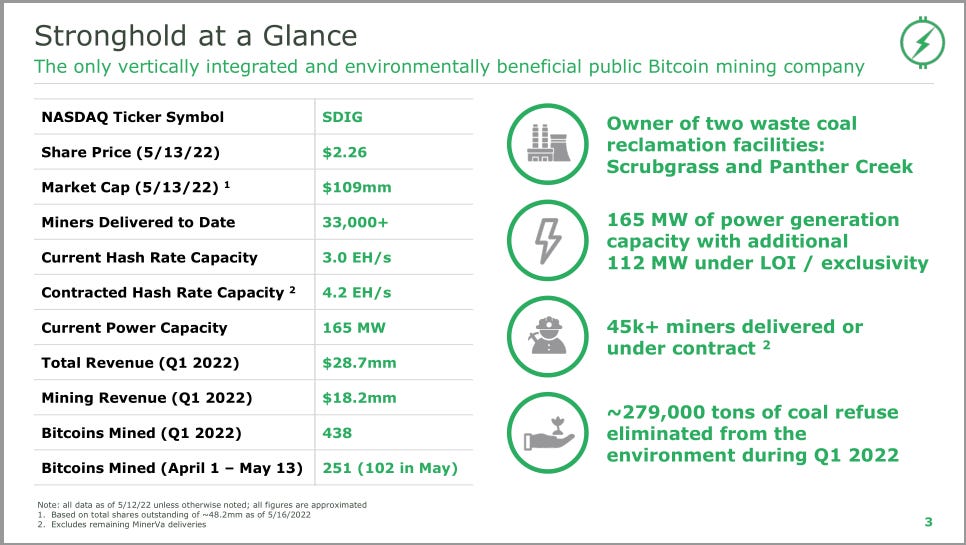

In summary, I think they have made decent progress and the shares trade at a very depressed valuation. As the CEO noted, power assets typically trade at 5-10x cash flows while they are trading at around 2x their power cash flows (as a private equity operator when he says cashflow he’s referring to adjusted EBITDA) without giving any value for the bitcoin mining operation.

They highlighted an adjusted EBITDA from just selling power at the forward market prices of $50m at the midpoint.

Against a current Enterprise Value of $215m that’s 4.3x EV/EBITDA assigning zero value to the bitcoin mining business, which has very material upside optionality to bitcoin prices.

They are fully funded out to a year end hash rate of 4.1EH and are showing signs of turning things around in a measured way after the disappointment of Q4 2021. Given the shares trade at such depressed levels, I believe the risk-reward is very attractive down here, albeit this is a story with many moving parts and plenty of complexity so not one for your grandmother. The new CFO looks to be a strong addition to the team and the pedigree of the CEO remains a material positive factor when considering the probability of their success.

The key highlights from the quarter:

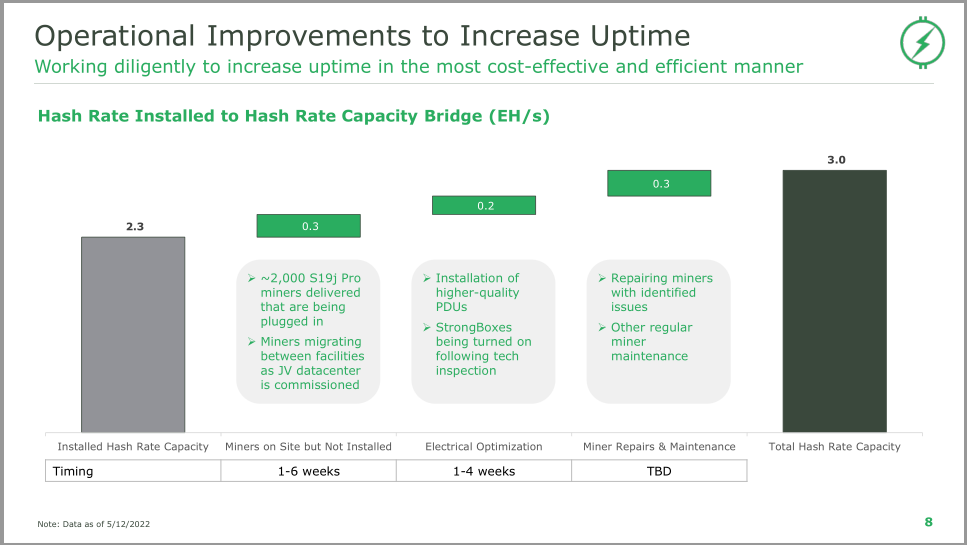

They are up to 2.3EH of active hash rate and they have 3.0EH current capacity. They laid out plans to bridge the gap between hash rate and capacity (more below).

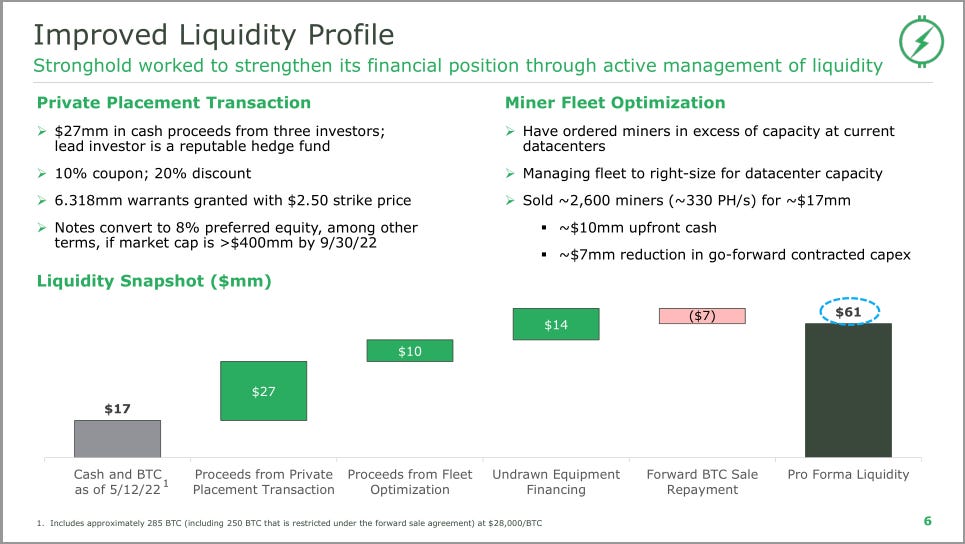

They raised $27m cash from a private placement of notes with warrants which convert to preferred equity if market cap is above $400m by 30 Sep 2022 (4x in 5 months would be nice!).

They have $61m in liquidity pro-forma for this transaction which they believe funds them fully to get to 4.1EH guided hash rate by year end.

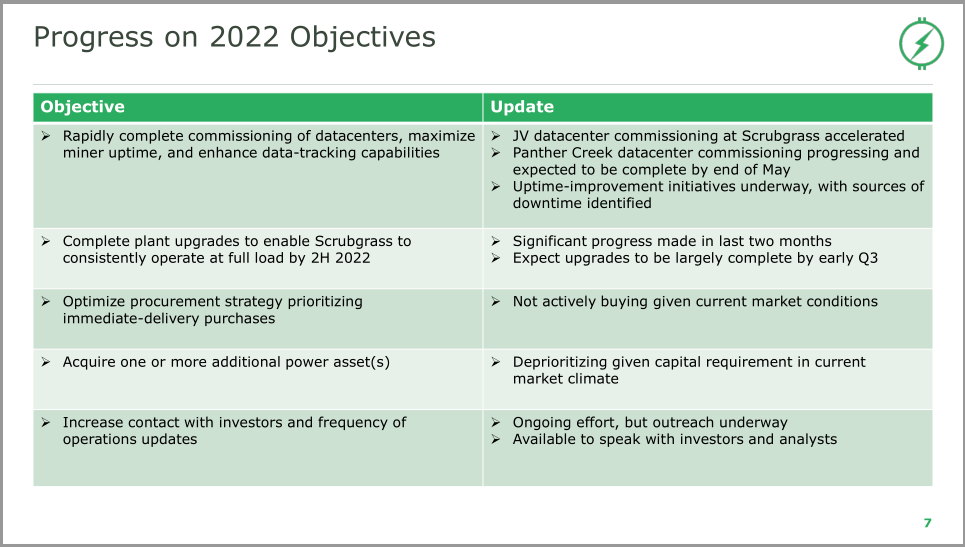

They have dialled down growth plans given tougher market. Not looking at actively buying more mining rigs in here nor looking to close 3rd power plant deal any time soon.

They want to be in a position to play offence in a more difficult market:

They have the benefit of being able to sell power very profitably if bitcoin mining economics worsen further (more detail below) which their peers don’t have.

This optionality positions them well in a continued downturn.

They plan to generate cash, build their balance sheet back up, be in a position to either take advantage of dislocations in the market or potentially to buy back stock next year (they didn’t explicitly say this but v clear implication from the new CFO who came across v well - v strong investor background).

They have started the improvements/ maintenance on the Scrubgrass plant. The last delivery of parts for this comes in July so they want until late Q3/ end of year to be able to show uptime that they’re proud of.

The release states the upgrades remain on track to be completed early in H2 2022. I think the CEO wants analysts to remain conservative in their modelling to be able to deliver positive surprises after the v poor prior quarter.

On that note, the CEO stressed that he wanted analysts to model no deliveries from MinerVa but said that the situation was a bit better than that.

They have taken a $12m impairment against this contract but deep down I think the CEO hopes/ expects to get some miners delivered here before year end.

They have received all the miners for the JV with Northern Data.

Have now commissioned 14 of the 24 total pods, up from 4 in late March.

Remaining 10 pods to be operational in next 1-2 months.

Less positive aspects:

They had a 10 day downtime period at the Panther Creek plant in April due to switch gear failing in the data centre. It had been operating at 1.2EH prior to the failure. They lost $2.2m worth of BTC output for the period, partially offset by energy sales of $0.8m so a net $1.4m impact.

The Scrubgrass plant remains challenged, although they noted April output was up 20% vs Q1 2022 levels.

The key negative for me is that even if you adjust the P&L for the MinerVa impairment and impairing for downwards move in BTC prices you still get P&L losses in both the crypto mining and the energy segments. A bridge between this and their stated potential adjusted EBITDA for the year of $35-65m would be very helpful, laying out what amount of costs are one-off etc. To balance this, it is worth noting they had a number of issues in Q1 which depressed revenues so we will hopefully see profitability emerge as revenues increase without an associated increase in costs.

One negative that emerged from reviewing the filing was the statement that they can be forced to make electricity sales to the PJM grid at uneconomical levels and there was more of this than they had anticipated in Q1 2022. This is more likely to happen during times of high demand, at which time the electricity price should be on the high side but the fact that they don’t get to choose when to sell electricity is a risk factor to bear in mind.

Further review of the result:

They mined 438 BTC in Q1 at average hash rate of 0.9EH which they’d already disclosed last quarter.

In April they mined 149 (this included the 10 day outage at Panther Creek).

From May 1 to May 13 they mined 102 BTC. This is a much healthier 7.8 BTC per day rate and the first concrete evidence of them turning around their operating performance after Q1’s disappointment.

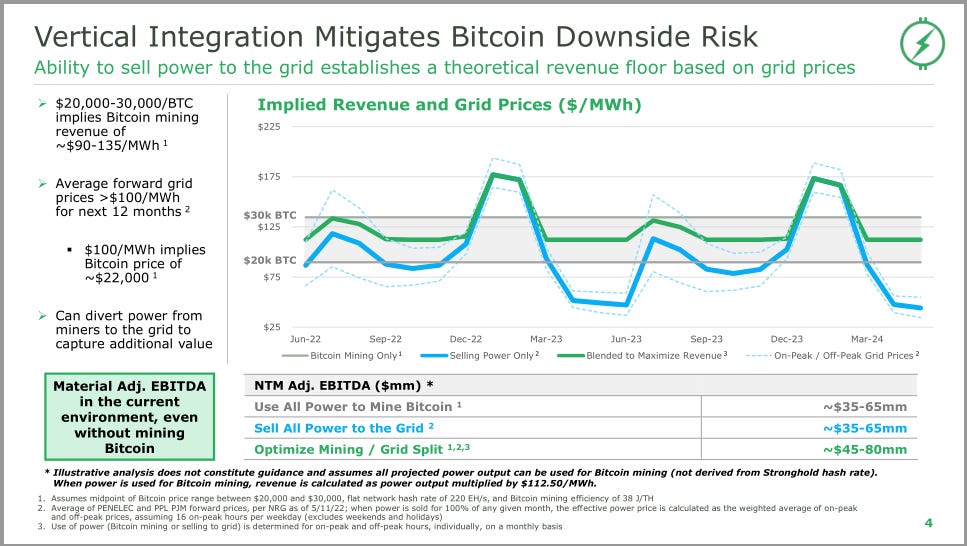

The downside protection from selling power into the grid:

Stronghold’s business model is quite distinct from the other bitcoin miners in that they own their own power plants (Greenidge also do) and can therefore choose to use the electricity those plants generate either to mine bitcoin or to sell it back to the PJM grid depending on which is most profitable.

The slide below from their Q1 presentation lays out the comparison between mining bitcoin and selling electricity based on the forward electricity price curve out to March 2024.

Some notes:

The average forward electricity price on the relevant parts of the PJM grid (average of PENELEC and PPL prices) is over $100/ MWh for the next 12 months.

A bitcoin price range of $20k-$30k and current mining economics (network hash rate of 220EH) equates to Bitcoin mining revenue of $90-135/ MWh.

The $100/ MWh forward electricity price level on their analysis is the equivalent of a $22,000 bitcoin price in terms of bitcoin mining revenue.

So there is a theoretical revenue floor whereby if bitcoin prices go below $22k then it they are better off selling electricity to the grid.

They show a next twelve months potential adjusted EBITDA range from selling all power to the grid of $35-65m.

Note the big spikes in the blue line (forward electricity prices in $/MWh terms) in Dec 22- Feb 23 and Dec 23- Feb 24 periods reflecting the seasonal aspect of electricity pricing. It is exactly during those periods of peak demand that the PJM is most likely to demand that Stronghold sell its electricity to the grid so hopefully the majority of any forced sales to the grid will come with decent economics.

Fully funded to get to 4.1EH by end 2022:

The slide below shows their liquidity position pro-forma for the $27m cash received from the recent private placement transaction.

Some notes:

To get the deal done they had to pay pretty onerous terms; a 10% coupon, notes priced at a 20% discount to par, warrants with $2.50 strike attached.

But, being able to get to the 4.1EH fully funded is not priced into the current valuation of the shares so the increased visibility into that goal is worth significant upside to the stock price as it stands from my perspective.

They sold 330PH worth of miners for $17m. This is because their power capacity of 165m can power around 4.3EH at an efficiency of 38 W/ TH (which is what they guide for). If they do receive MinerVa miners to end up in excess of 4.3EH they will likely sell more miners to improve the balance sheet further. If all MinerVa miners got delivered they would have 2EH of excess miners.

Progress made on 2022 objectives so far:

The slide below shows they have made some material progress in turning things around.

Bridge from 2.3EH current hash rate to 3EH current capacity.

They laid out the steps needed to close this gap over the next couple of months in the slide below. They did acknowledge facing miners that needed repairing which highlights one of the downsides of their strategy to source many disparate types of miners from many manufacturers and suppliers - less reliable operation. They highlighted power supplies and fan failures in particular as being the areas causing problems. In their defence, they have only called out 0.3EH worth of miners as facing issues.

Highlights from the Q&A:

They reminded that their stated hash rate includes the JV with Northern Data for 1.4EH under which terms they pay Northern Data 35% of the revenue and keep 65% (while also charging Northern Data $0.027/ kWh for power).

Reconciling their commentary about playing offense with not currently looking to grow assets:

They thought the economics of the industry would worsen but that it would not happen this soon.

They don’t want to be in the forward market buying miners today - most folks that have done that are probably regretting that decision.

They’ll continue to evaluate power assets, that’s a core strength of theirs. But they’ll be really careful about how they finance any purchase, not taking on too much leverage in a volatile market.

They see themselves as being opportunistic, putting themselves on the front foot with the potential to be more aggressive. If the market gets tougher then their peers can’t survive an extended downturn in the market but their business model with the optionality between bitcoin mining and power selling, can, which inevitably would mean opportunities coming their way if the markets suffer.

CEO noted that on the flipside, their model allows them to participate in the upside as much as anyone else (which is true apart from them not holding BTC on their balance sheet so don’t get the revaluation benefit there).

CFO had some helpful commentary including some colour on next year:

They want to maintain maximum financial flexibility in the face of an extraordinary network hash rate build out if you look at the plans of the 15-20 public miners.

Re their private placement; the IPO market is closed, the secondary market is closed, bonds of their peers are trading in the 20s from a yield perspective so they’re happy for investors to see the merit of the integrated model. Most of the focus (of investors in the private placement) was on the earnings potential of the power business as a downside mitigating factor.

If you look into 2023, then without giving guidance you can see where FCF starts to be a material part of the conversation and where deleveraging starts to take place.

If their shares remain as depressed as they are they could have flexibility to force the market to look at them in a different way. If you think about the denominator as your shares and the assets are the numerator then you can acquire miners or power plants or you can reduce the denominator.

So he’s clearly putting out the prospect of them potentially buying back stock next year once they’ve delevered beyond a certain point.

The CEO later on in the call added that they will be generating a lot of cash, they’ll pay down equipment financing and grow at an appropriate rate using their free cash flow.

Views on network hash rate:

CEO still thinks we could see an adjustment in network hash rate (lower). Any equipment that’s been ordered and paid for and can plug in then the economics are still good so should expect them to be plugged in.

But there is a lot of hash rate that was ordered and not paid for - there we’ll see the implications of the financing markets closing on both the equity and debt side.

Should expect to see older, less economic machines come offline.

A bigger implication is on modelling out next year’s hash rate growth given once the capital is gone, it’s much tougher to grow in this business.

So they expect a flat hash rate or a moderately growing one.

Their model ultimately puts them in a better place as a survivor of a tough market than if financing markets were open, even though not fun to go through.

CEO on their valuation:

The right cash flow multiple to put on a power business is not 2x cash flow. It’s probably 5-10x depending on the market and the growth rate.

They want investors to think of them either as a power business that has a massive option on Bitcoin or a Bitcoin business with downside protection from having a power asset.

Right now they think they’re getting the lowest view of both.

I’d agree with this, they are being valued very cheaply vs their earnings potential with the downside protection from power generation revenues not being properly factored in.

would love to see an update